(SNews) – In recent years, governments around the world have been pushing radical policies that have fueled a global energy crisis.

It would be easy to assume that the decisions that have triggered soaring energy prices are just plain incompetence.

However, the global energy crisis conveniently falls into line with the long-planned strategy of Western corporate and political circles to dismantle industrial economies in the name of the globalist green agenda.

Democrat President Joe Biden’s administration and European Union insist that soaring energy costs are due to Vladimir Putin and Russia’s military actions in Ukraine.

But this simply isn’t true and the situation was festering for years before Russia launched its military action in Ukraine in February 2022.

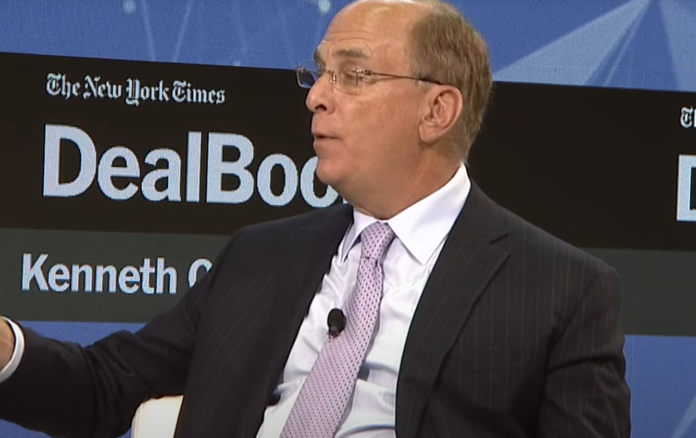

In January 2020, on the eve of the economically and socially devastating Covid lockdowns, Larry Fink, the CEO of the world’s largest investment fund BlackRock, issued a letter to Wall Street colleagues and corporate CEOs on the future of investment flows.

In the document, modestly titled “A Fundamental Reshaping of Finance,” Fink announced a radical departure for corporate investment.

He declared that money would “go green.”

At the time, BlackRock had some $7 trillion under management.

In his closely-followed 2020 letter, Fink asserted that funds will be reallocated into green agenda investments.

“In the near future – and sooner than most anticipate – there will be a significant re-allocation of capital,” Fink declared.

“Climate risk is investment risk.”

“Every government, company, and shareholder must confront climate change,” he added.

In a separate letter to Blackrock investor clients, Fink delivered the new agenda for capital investing.

He declared that Blackrock will exit certain high-carbon investments such as coal, the largest source of electricity for the USA and many other countries.

He added that Blackrock would screen new investments in oil, gas, and coal to determine their adherence to the United Nations Agenda 2030 “sustainability.”

Fink made clear the world’s largest fund would begin to disinvest in oil, gas, and coal.

“Over time, companies and governments that do not respond to stakeholders and address sustainability risks will encounter growing skepticism from the markets, and in turn, a higher cost of capital,” Fink wrote.

“Climate change has become a defining factor in companies’ long-term prospects… we are on the edge of a fundamental reshaping of finance,” he added.

From that point on the so-called ESG investing, penalizing CO2 emitting companies like ExxonMobil, has become a rising trend among hedge funds and Wall Street banks.

Major investment funds including State Street and Vanguard have since gone “woke.”

Such is the power of BlackRock.

Fink was also able to get four new board members in ExxonMobil committed to ending the company’s oil and gas business.

The January 2020 Fink letter was a declaration of war by big finance against the conventional energy industry.

BlackRock was a founding member of the Task Force on Climate-related Financial Disclosures (the TCFD) and is a signatory of the UN PRI— Principles for Responsible Investing, a UN-supported network of investors pushing zero carbon investing using the highly-corrupt ESG criteria—Environmental, Social and Governance factors into investment decisions.

There is no objective control over fake data for a company’s ESG.

BlackRock also signed the Vatican’s 2019 statement advocating carbon pricing regimes.

In 2020, BlackRock joined Climate Action 100, a coalition of almost 400 investment managers managing US$40 trillion.

With that fateful January 2020 CEO letter, Larry Fink set in motion a colossal disinvestment in the trillion-dollar global oil and gas sector.

That same year BlackRock’s Fink was notably named to the Board of Trustees of Klaus Schwab’s dystopian World Economic Forum (WEF), the corporate and political nexus of the Zero Carbon UN Agenda 2030.

In June 2019, the WEF and the United Nations signed a strategic partnership framework to accelerate the implementation of the 2030 Agenda.

The WEF has a Strategic Intelligence platform that includes Agenda 2030’s 17 Sustainable Development Goals.

In his 2021 CEO letter, Fink doubled down on the attack on oil, gas, and coal.

“Given how central the energy transition will be to every company’s growth prospects, we are asking companies to disclose a plan for how their business model will be compatible with a net zero economy,” Fink wrote.

Another BlackRock officer told a recent energy conference, “Where BlackRock goes, others will follow.”

In just two years, by 2022 an estimated $1 trillion has exited investment in oil and gas exploration and development globally.

Oil extraction is an expensive business and the cut-off of external investment by BlackRock and other Wall Street investors spells the slow death of the industry.

In late 2019, early in his then-lackluster presidential bid, now-Presdient Joe Biden had a closed-door meeting with Fink.

Fink reportedly told the Democrat candidate that, “I’m here to help.”

After his fateful meeting with BlackRock’s Fink, candidate Biden announced, “We are going to get rid of fossil fuels…”

In December 2020, even before Biden was inaugurated in January 2021, he named BlackRock’s Global Head of Sustainable Investing, Brian Deese, to be Assistant to the President and Director of the National Economic Council.

Here, Deese, who played a key role for Obama in drafting the Paris Climate Agreement in 2015, has quietly shaped “Biden’s” war on energy.

This has been catastrophic for the oil and gas industry.

Fink’s man Deese was active in giving the new President Biden a list of anti-oil measures to sign by Executive Order beginning day one in January 2021.

That included closing the huge Keystone XL oil pipeline that would bring 830,000 barrels per day from Canada as far as Texas refineries.

The Democrat president also halted any new leases in the Arctic National Wildlife Refuge (ANWR).

Biden also rejoined the Paris Climate Accord that Deese had negotiated for Obama in 2015 and President Donald Trump later canceled.

The same day, Biden set in motion a change of the so-called “Social Cost of Carbon” that imposes a punitive $51 a ton of CO2 on the oil and gas industry.

That one move, established under purely executive-branch authority without the consent of Congress, is dealing a devastating cost to investment in oil and gas in the US, a country only two years before that was the world’s largest oil producer.

Even worse, Biden’s aggressive environmental rules and BlackRock ESG investing mandates are killing the US refinery capacity.

Without refineries, it doesn’t matter how many barrels of oil you take from the Strategic Petroleum Reserve.

In the first two years of Biden’s Presidency, the U.S. has shut down some 1 million barrels a day of gasoline and diesel refining capacity.

Some of this was due to Covid demand collapse, the fastest decline in U.S. history.

The shutdowns are permanent, however.

In 2023 an added 1.7 million BPD of capacity is set to close as a result of BlackRock and Wall Street ESG disinvesting and Biden regulations.

Citing the heavy Wall Street disinvestment in oil and the Biden anti-oil policies, the CEO of Chevron in June 2022 declared that he doesn’t believe the U.S. will ever build another new refinery.

Larry Fink, a Board member of Klaus Schwab’s WEF, is joined by the EU.

The President of the EU Commission, the notoriously corrupt Ursula von der Leyen, left the WEF Board in 2019 to lead the ultra-powerful unelected commission.

Her first major act in Brussels was to push through the EU Zero Carbon Fit for 55 agenda.

That has imposed major carbon taxes and other constraints on oil, gas, and coal in the EU well before the February 2022 Russian actions in Ukraine.

The combined impact of the Fink fraudulent ESG agenda in the Biden administration and the EU Zero Carbon madness is creating the worst energy and inflation crisis in history.

slaynews.com/news/how-blackrock-triggered-global-energy-crisis/