Over 800,000 fewer native-born Americans are currently employed compared to the previous year, as job growth for this demographic continues to fall short of that of foreign-born workers, according to the Bureau of Labor Statistics (BLS).

Data from the BLS indicates that the number of employed foreign-born workers rose by approximately 1.2 million year-over-year in September, while there was a decrease of 825,000 in the employment of native workers. This significant annual disparity persists despite a notable increase of around 920,000 in employment for native-born workers in September compared to August, following a decline of 1,325,000 from July to August.

Overall job growth in September was stronger than anticipated, with the U.S. economy adding 254,000 nonfarm payroll jobs, surpassing economists’ expectations of 150,000.

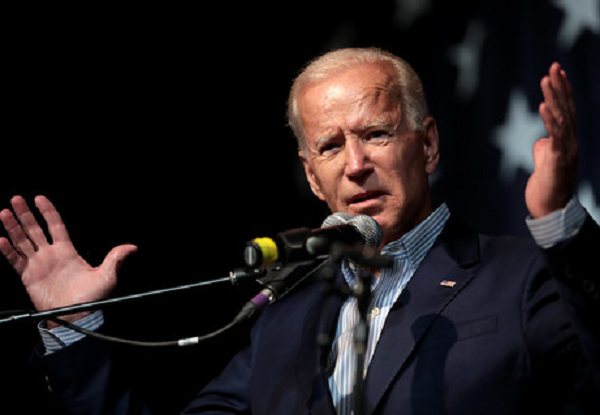

“Today, we received good news for American workers and families,” the Biden-Harris administration wrote in a press release Friday following the publication of the September jobs report. “With today’s report, we’ve created 16 million jobs, unemployment remains low, and wages are growing faster than prices.”

Employment of native-born Americans had a very steady upward trend before '20, but has never recovered to that level, let alone the trend; there are 452k fewer of them employed today than pre-pandemic, w/ all net job growth going to foreign-born workers – over 4 million jobs: pic.twitter.com/9vr464KJzD

— E.J. Antoni, Ph.D. (@RealEJAntoni) October 4, 2024

Real wages have experienced a decline of 1.3% in real terms from the first quarter of 2021 to the second quarter of 2024, as inflation during the Biden administration continues to impact American consumers. Since President Biden assumed office in January 2021, prices have surged by over 20%, with inflation escalating from 1.4% at the end of former President Donald Trump’s term to approximately 9% in June 2022.

In response to the soaring inflation, the Federal Reserve raised interest rates to a range of 5.25% to 5.50% in July 2023, marking the highest level in 23 years, before maintaining these rates until implementing a 0.5% reduction in September. The combination of high interest rates and persistent inflation has led many Americans to face financial distress, with delinquent credit card balances reaching their highest point since at least 2012 in the first quarter of 2024.