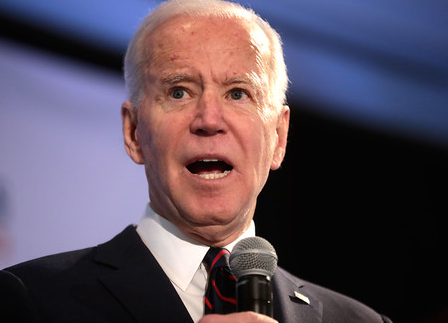

The Biden administration, led by Democrat President Joe Biden, has been exposed for instructing banks to scrutinize customer transactions containing keywords like “Trump” and “MAGA.”

In the aftermath of the January 6 Capitol protests, federal investigators requested financial institutions to identify any customers whose bank transactions indicated support for President Donald Trump.

Rep. Jim Jordan (R-OH) disclosed that this examination of customer data took place. The House Select Subcommittee on the Weaponization of the Federal Government obtained documents revealing that the request originated from the Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

Jordan, who chairs the panel, demanded testimony from Noah Bishoff, the former director of the agency’s Strategic Operations Division. This inquiry is part of an investigation into what the Ohio Republican described as a concerning instance of “pervasive financial surveillance” seemingly conducted based on “protected political” speech.

“The Committee and Select Subcommittee have obtained documents indicating that following January 6, 2021, FinCEN distributed materials to financial institutions that, among other things, outline the ‘typologies’ of various persons of interest and provide financial institutions with suggested search terms and Merchant Category Codes (MCCs) for identifying transactions on behalf of federal law enforcement,” Jordan wrote in a letter to Bishoff.

“These materials included a document recommending the use of generic terms like ‘TRUMP’ and ‘MAGA’ to ‘search Zelle payment messages,’” he noted.

Jordan stated that FinCen shared its analysis of “Lone Actor/Homegrown Violent Extremism Indicators” with financial institutions to aid in the identification of individuals involved in the Capitol riot. The analysis highlighted indicators of “extremism,” which encompassed activities like buying bus tickets, rental cars, or plane tickets for travel to destinations without any apparent purpose. Additionally, the purchase of books, including religious texts, and subscriptions to media platforms containing extremist views were also flagged as potential indicators.

“In other words, FinCEN urged large financial institutions to comb through the private transactions of their customers for suspicious charges on the basis of protected political and religious expression,” Jordan argues in the missive.

The legislator further alleged that FinCEN disseminated presentation materials elucidating the methods by which financial establishments can identify customers who match the characteristics of a “potential active shooter” or terrorists through their financial activities.

The presentation materials direct financial establishments to conduct searches for keywords like “Small Arms,” “Cabela’s,” and “Dick’s Sporting Goods,” alongside various other terms.

“Despite these transactions having no apparent criminal nexus — and, in fact, relate to Americans exercising their Second Amendment rights — FinCEN seems to have adopted a characterization of these Americans as potential threat actors,” Jordan wrote.

The panel chairman sent a separate letter on Wednesday, requesting FBI Director Christopher Wray to arrange a transcribed interview with a senior official from the bureau’s Strategic Partner Engagement Section. This interview is related to Bank of America’s collaboration with the FBI following January 6th.

Jordan is looking to expose the bureau’s “mass accumulation and use of Americans’ private information without legal process; the FBI’s protocols, if any, to safeguard Americans’ privacy and constitutional rights in the receipt and use of such information; and the FBI’s general engagement with the private sector on law-enforcement matters.”

At the behest of the FBI, the nation’s second-largest bank willingly and without any legal proceedings, conducted surveillance on individuals who had made certain purchases in and around Washington before and after the protests, as alleged by Jordan.

According to Jordan, Sullivan provided Bank of America with specific search terms to comb through customer data, specifically targeting purchases related to firearms, hotels, Airbnb, or airline tickets leading up to and following January 6, 2021.

In February 2021, Fox News reported that Bank of America had shared the information of 211 individuals with the FBI. Out of the 211 individuals, only one was summoned for questioning. According to the report from the outlet, none of them were arrested.